Fast and flexible financing

Need cash for emergencies, travel plans or big purchases? Get up to 50,000 SAR without salary transfer

Who can apply?

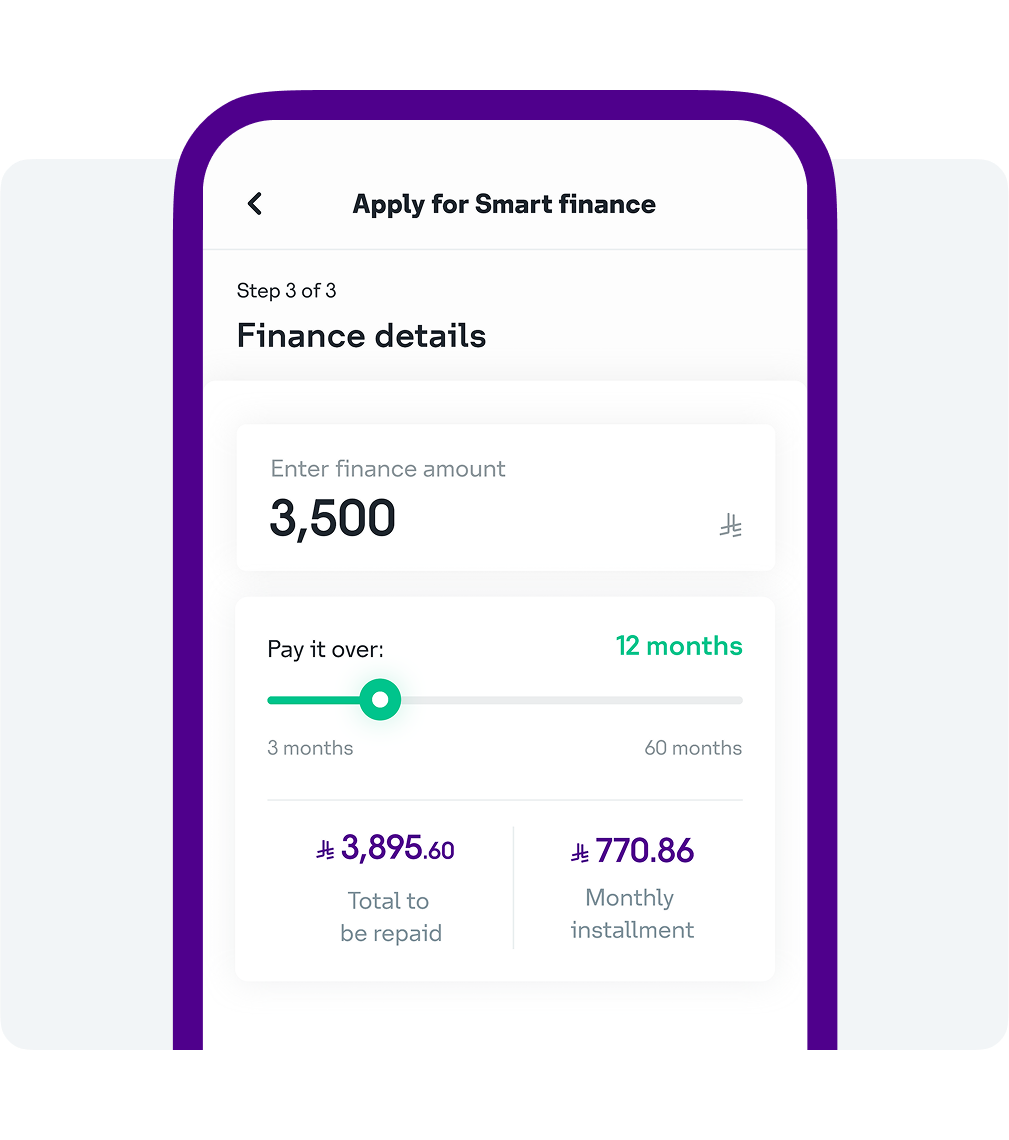

Get started in 3 steps

Fill out a simple application in the app

Review and accept your personalized offer

If approved, you’ll get your funds within 24 hours

FAQs

-

Is it really Shariah-compliant?

Yes, our finance products are fully approved by our dedicated Shariah board. Every aspect of the finance offering is reviewed to ensure it adheres to Islamic finance principles.

-

What are the profit rates?

The annual profit rate (APR) starts at 39% and may vary depending on the amount & duration the numbers below illustrate examples of finances and their APRs

Finance amount Financing Period Annual Percentage Rate Monthly installment 15,000 SAR 12 months 16.51 % 1,338 SAR 25,000 SAR 18 months 15.77 % 1,535 SAR 50,000 SAR 24 months 15.31 % 2,375 SAR * The table above is for example only. the APR may vary based on the finance amount, term, and each customer's credit history.

-

How long does it take to get approved?

We offer instant approval, and if all eligibility criteria are met, funds are usually disbursed within 24 hours.

-

What documents do I need to provide?

In most cases, no physical documents are needed. The application process is 100% digital and integrated with government platforms to retrieve your information instantly. However, additional verification may be requested in specific cases

-

Who is eligible for Smart Finance?

You are eligible if you meet the following criteria: • Saudi and Expatiriates • For employed cutomers, Max age 60 years. For retirees, max age is 67 • Employed in the Public, Private, Semi Government, and Retirees. • Min Salary 3,000 for saudis, 10,000 for expats

-

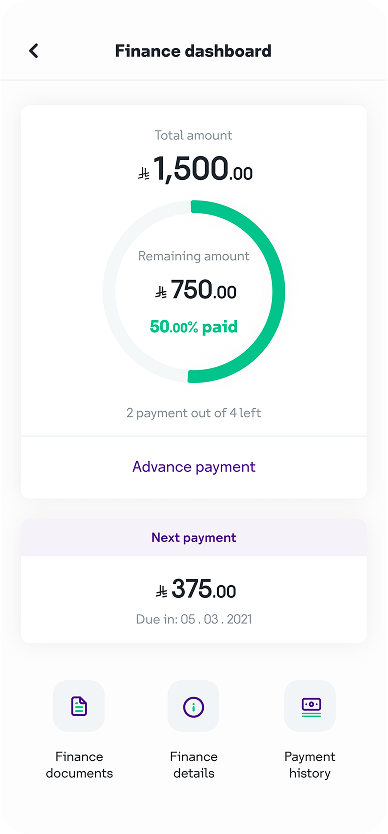

Can I pay the full amount at once?

Yes, you may request to settle the full remaining finance amount at any time. Early settlement profit may apply based on Shariah guidelines.

-

Can I cancel the finance if I change my mind?

Finance can be canceled only before funds are disbursed. Once funds have been transferred, cancellation is no longer possible, and the finance must be settled as per the contract.

-

Can I extend the repayment period after signing the contract?

No, the repayment period is fixed once the contract is signed. However, if you face financial difficulty, you may request rescheduling based on our policy and eligibility.

-

What happens if I miss a payment?

Missing a payment may result in: • A delay in your credit score with SIMAH • Accumulated dues • Limited access to future financing